Residential Zoned Land Tax (RZLT)

The Government’s Housing For All – A New Housing Plan for Ireland proposed a new tax to activate vacant land for residential purposes as a part of the Pathway to Increasing New Housing Supply.

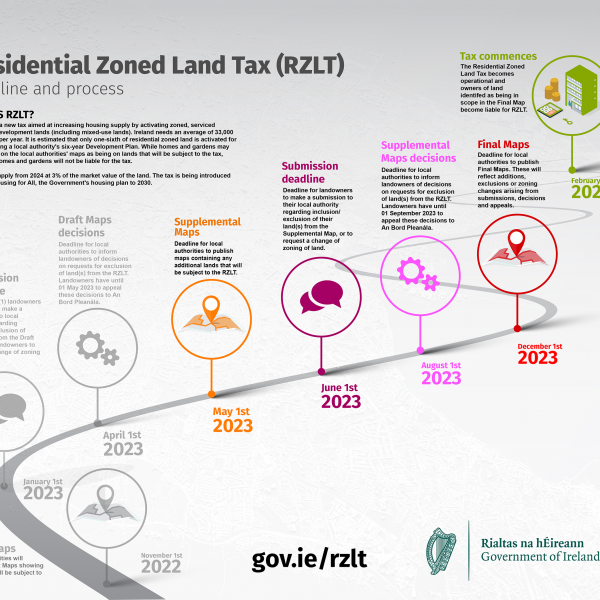

The Residential Zoned Land Tax was introduced in the Finance Act 2021. The process to identify land to which the tax applies is ongoing and the tax will be due from February 2025 and payable from 23 May 2025.

The tax aims to activate serviced, zoned land for residential or mixed use. This is to boost housing supply and regenerate vacant, idle urban land. These locations have been identified within statutory land use plans as being appropriate locations for housing and they have benefitted from investment in the key services to support the delivery of housing.

The RZLT process has two parts:

1) Identification and mapping of the land in scope for the tax. This is undertaken by local authorities through the publication of annual draft and annual final maps – see below.

2) Administration of the tax. This will be undertaken by the Revenue Commissioners.

The final map for 2025, published by 31 January 2025, identifies land that may be liable for the tax in 2025. Owners of such land may make a request to Fingal County Council to change the zoning of this land until 1 April 2025. If certain conditions are met, a landowner may be exempt from the 2025 liability on foot of such a request.

The draft map for 2026, which will be published by 1 February 2025, identifies land that may be liable for the tax in 2026. Owners of such land – and interested third parties - may make submissions regarding the inclusion of land on this draft map – these submissions must be made by 1 April 2025.

Please note that although they are included on these maps, residential properties are not subject to RZLT if they are subject to Local Property Tax. It is not necessary to make a rezoning request or submission to remove this type of residential property from the map.

Identification of land liable to RZLT in 2026

Fingal County Council has prepared an annual draft map for 2026, identifying the land considered to be in scope for the RZLT as of January 1 2025.

The annual draft map is available below/ https://consult.fingal.ie and at

Fingal County Council Offices:

(During normal office hours, Monday to Thursday 9.00am – 5.00pm and Friday 9.00am to 4.30pm):

- County Hall, Main Street, Swords, Co. Dublin, K67 X8Y2

- Civic Offices, Grove Road, Blanchardstown, Dublin 15, D15 W638

Any interested individuals or parties may make submissions in respect of land on the annual draft map. This is dealt with in further detail below.

Please note that although they are included on the map, residential properties are not subject to RZLT if they are subject to Local Property Tax. It is not necessary to make a submission to remove this type of residential property from the map.

Land appearing on the annual draft maps, taking into consideration submissions, will be included on the annual final map of land in scope for the tax in the local authority area. This map will be published on 31 January 2026. This land may be subject to the tax in 2026, unless it is a residential property subject to Local Property Tax or qualifies for other exemptions, as provided for in the legislation.

The RZLT map as prepared and published by the local authorities indicates lands that meet the relevant criteria for inclusion on the map, as set out in the legislation.

The administration of the RZLT is a matter for the Revenue Commissioners.

The legislation underpinning the RZLT can be found in Part 22A of the Taxes Consolidation Act 1997. Guidance in respect of the administration of the tax may be found here.

The Department of Housing, Local Government and Heritage has published guidance on the Residential Zoned Land Tax. It aims to help planning authorities publish the maps. It can be viewed here.

You can find answers to some frequently asked questions about the RZLT and how to make a submission here

Making a submission on the annual draft map for 2026

Submissions can be made by 1 April 2025 to:

- Identify additional land that may fall into scope, but is not included in the annual draft map for 2026;

- Challenge the inclusion of land on the map if the owner considers that the land does not meet the criteria that determines the land in scope;

- Challenge the date from which the land is considered to be in scope; and/or

- Support the proposed exclusion of their land.

Please note your submission must clearly identify the site and outline what change (i.e. exclusion of land on a local authority map, the date on which the site first met the criteria for inclusion on the map, or support for the proposed exclusion of land from the map) to the Residential Zoned Land Tax mapping you are seeking, as well as provide a justification for the change sought. The submission must state the criteria set out in Section 653B of the Taxes Consolidation Act 1997 on which you rely in your submission for the land being in or out of scope. After reviewing your submission, the local authority may request additional information, such as proof of ownership.

Landowner submissions

If you are making a submission in respect of land that you own or on behalf of the landowner, please note the following:

- Your name and address must be included in the submission.

- Submissions from a landowner in respect of their own land must be accompanied by an Ordnance Survey map showing the property at an appropriate scale, 1:1000 (urban areas) or 1:2500 (rural areas) suitable to identify the land in question. Please note the local authority may request proof of site ownership.

- If your land is on the map, you may wish to bring to the local authority’s attention to matters that demonstrate that the land is not in scope for the tax, or that the date that the land was considered in-scope is not correct and should be changed.

- Reference to criteria in Section 653B of the Taxes Consolidation Act 1997 – any submission should reference these, along with evidence for consideration by the local authority to support any claims regarding the serviced nature of the land or any exclusions that should be applied. These criteria must also be referenced if the submission seeks to include additional land on the map.

- The submission should set out any justification for inclusion or exclusion of land,

with reference to the criteria in the legislation.

Third Party submissions

If you are making a submission about land that you don’t own, then you are a third-party submitter.

In your submission you should include:

- Your name and address.

- Information to identify the land - either a written description, an Eircode or a map with the area outlined. Where the local authority cannot identify the land, it may not be able to take the submission into account.

- For land on the map, you may wish to bring to the local authority’s attention to matters that demonstrate that the land is not in scope for the tax, or that the date that the land was considered in-scope is not correct and should be changed.

- Reference to criteria in Section 653B of the Taxes Consolidation Act 1997 – any submission should reference these, along with evidence for consideration by the local authority to support any claims regarding the serviced nature of the land or any exclusions that should be applied. These criteria must also be referenced if the submission seeks to include additional land on the map.

- The submission should set out any justification for inclusion or exclusion of land,

with reference to the criteria in the legislation.

In what format should the submission be made?

Submissions:

Submissions regarding –

(I) either the inclusion in or exclusion from the final map of specific sites, or

(II) the date on which a site first satisfied the relevant criteria.

on the annual draft map may be made:-

- Online at the Council’s Consultation Portal at https://consult.fingal.ie/ or

- In writing to Senior Executive Officer, Planning and Strategic Infrastructure Department, Fingal County Council, County Hall, Main Street, Swords, Co. Dublin K67 X8Y2 before 11.59pm on 1 April 2025.

In respect of making any submission, be it by the landowner or a third party, please note the following:

- The personal information (data) collected during the consultation process is collected for the purpose of receiving and dealing with submissions.

- Contact details provided may be used to contact a submitter who claims to be the landowner of a particular site. This will be to request evidence as is necessary to prove their ownership of the site, or request further information from the landowner.

- A local authority may, where it considers it necessary for the purposes of making the determination, request further information from Irish Water, the National Roads Authority or from a person referred to in article 28 of the Planning and Development Regulations 2001.

- For further information on how Fingal County Council processes Personal Data, please see our Privacy Statement https://www.fingal.ie/privacy-policy

- Please identify any parts of your submission that contain personal or commercially sensitive data that you do not wish to be published.

What Happens Next

The local authority will evaluate all written submissions. Then, it will decide and issue a written response to landowners' submissions. Before publishing the final map each year, it will take key steps, including the following:

2026 Annual Draft Map

Please click RZLT - FCC Annual Draft Map 2026 to see the 2026 draft annual map.

- Submissions received in relation to the annual draft map will be published on the local authority website by 11 April 2025 (note: personal data, i.e. name, address of submitter and contact details of the submitter, are redacted, but location of lands to which the submission relates are published along with the grounds of the submission).

- Where a landowner requests the exclusion of their land from the annual draft map on the basis that it does not meet the criteria for being in scope, or challenges the date from which land on the map met this criteria, the local authority must notify the owner of its decision not later than 1 July 2025.

- An appeal of the local authority decision on a landowner’s submission on the annual draft map must be lodged by the landowner with An Bord Pleanála by 1 August 2025.

Where a person has requested the addition of a site to the draft map and the local authority considers that site satisfies the relevant criteria, then it will be identified on the next annual draft map, which will be published by the local authority on the following 1 February.

Can I appeal a decision of the local authority?

A landowner has until 1 August 2025 to appeal the local authority decision regarding submissions. Appeals may be made to An Bord Pleanála in respect of the exclusion of their site from the annual draft map for 2026 on the basis that it does not meet the criteria for being in scope, or challenging the date from which land on the map met this criteria date to. Appeals must be made in writing setting out the grounds of appeal. There are no provisions for a third party to appeal a local authority decision to retain or remove land from an annual draft map.

Making a rezoning request on a final map for 2025 (published 31 January 2025)

An additional provision was made in the Finance Act 2024, facilitating a further round of rezoning requests to remove land from liability to the tax. Rezoning requests can only be made for land identified on the final annual map for 2025, published on 31 January 2025. Rezoning requests for other land will not be considered.

Submissions requesting a change of zoning are considered by the local authority. The rezoning request must be made to the relevant local authority between 1 February and 1 April 2025.

- A rezoning request acknowledgement letter containing details of the recent planning history of the land will be issued by 30 April 2025 from the local authority to the landowner.

- The local authority will communicate in writing to the landowner its decision on whether to progress with an intended variation to the statutory land use plan by 30 June 2025.

- Decisions on rezoning requests cannot be appealed to An Bord Pleanála.

The rezoning request acknowledgement letter can be used to support a claim for an exemption from the tax for 2025. This claim must be made in the 2025 annual return, which must be made to the Revenue Commissioners on or before 23 May 2025.

Please click RZLT - FCC Annual Final Map 2025 to see the 2025 Final Map published 31 January.

Landowner Rezoning Requests

If you are making a rezoning request in respect of land that you own, or on behalf of a landowner, please note the following:

- Your name and address must be included in the submission.

- Submissions must be accompanied by an Ordnance Survey map showing the property at an appropriate scale, 1:1000 (urban areas) or 1:2500 (rural areas) suitable to identify the land in question. Please note the local authority may request proof of site ownership.

- Please note that a submission requesting a change in zoning can only be made in relation to land that is already on the final map for 2025, published on 31 January 2025.

- Where a land use zoning change is sought, the submission must be received on or before 1 April 2025.

- The landowner should set out why the change in zoning is in the interest of the proper planning and sustainable development of the area, as well as any other circumstances, such as their desire to continue with an ongoing economic activity they wish to bring to the local authority’s attention. Any information to support the claims of ongoing economic use should be submitted as part of the rezoning request.

How can I find out further information about the mapping and submissions process?

You can find answers to some frequently asked questions about the RZLT and how to make a submission here

For questions about specific land or not covered in FAQs, please contact the Planning Department [email protected]

Further information on the process is also available on the Gov.ie/RZLT website.

As outlined above, the RZLT process has two parts. Local authorities are required to undertake the mapping that identifies the land subject to the tax. The local authority is also responsible for publishing the annual final map. This was published on 31 January 2025 for the 2025 year, and will be revised annually. Thereafter, the administration of the tax will be undertaken by the Revenue Commissioners. Queries on the mapping should be made to [email protected] . This includes queries on:

- Criteria for inclusion on annual draft map

- Submissions on annual draft map

- Determinations on annual draft map

- Appealing a determination (which must be submitted to An Bord Pleanála)

- Annual final map

- Zoning submissions on the annual final map for 2025 published 31 January 2025

All queries regarding the administration of the tax should be directed to the Revenue Commissioners. Its website provides details on the general administration of the tax and links to a comprehensive guide to the tax. The Revenue website also provides details on:

- Liable persons

- Amount of residential-zoned land tax

- Obligation to register

- Obligation on liable person to prepare and deliver return

- Deferral of, or exemptions from, Residential Zoned Land Tax

- How to contact Revenue with queries on the administration of RZLT

What do I do if I am a Homeowner

My house and garden is contained on the map. What is the consequence?

Your house and garden are identified on the map because it meets the criteria for the tax, which is based on residential-led zonings and servicing by infrastructure suitable for the provision of housing. The house and garden are not liable for the tax, as long as the house is subject to Local Property Tax (LPT).

Do I need to make a submission?

It’s not necessary. Even if your house is identified on the maps, residences are not liable for the tax where they are subject to LPT.

What if my garden is greater than 0.4047ha (1 acre) –

If your garden is greater than this size, then you need to register for the RZLT with the Revenue Commissioners, however your house and garden will not be liable for the tax. You will be able to register for RZLT from Q1 2025 onwards. No action needs to be taken to register at this time. Please see revenue.ie for details regarding the registration process closer to the time.

Section 653B of the Taxes Consolidation Act 1997 states:-

In this Part, a reference to land which satisfies the relevant criteria is a reference to land that—

(a) is included in a development plan, in accordance with section 10(2)(a) of the Act of 2000, or local area plan, in accordance with section 19(2)(a) of the Act of 2000, zoned—

(i) solely or primarily for residential use, or

(ii) for a mixture of uses, including residential use,

(b) it is reasonable to consider may have access, or be connected, to public infrastructure and facilities, including roads and footpaths, public lighting, foul sewer drainage, surface water drainage and water supply, necessary for dwellings to be developed and with sufficient service capacity available for such development, and

(c) it is reasonable to consider is not affected, in terms of its physical condition, by matters to a sufficient extent to preclude the provision of dwellings, including contamination or the presence of known archaeological or historic remains, but which is not land—

(i) that is referred to in paragraph (a)(i) and, having regard only to development (within the meaning of the Act of 2000) which is not unauthorised development (within the meaning of the Act of 2000), is in use as premises, in which a trade or profession is being carried on, that is liable to commercial rates, that it is reasonable to consider is being used to provides services to residents of adjacent residential areas,

(ii) that is referred to in paragraph (a)(ii), unless it is reasonable to consider that the land is vacant or idle,

(iia) the development of which would not conform with—

(I) in a case in which the land is zoned in a development plan, the phased basis in accordance with which development of land is to take place under the plan, as detailed in the core strategy included in that plan in accordance with section 10(2A)(d) of the Act of 2000, or

(II) in a case in which the land is zoned in a local area plan, the objective, consistent with the objectives and core strategy of the development plan for the area in respect of which the local area plan is prepared, of development of land on a phased basis, included in the local area plan in accordance with section 19(2) of the Act of 2000, on the date on which satisfaction of the criteria in this section is being assessed,

(iii) that it is reasonable to consider is required for, or is integral to, occupation by—

(I) social, community or governmental infrastructure and facilities, including infrastructure and facilities used for the purposes of public administration or the provision of education or healthcare,

(II) transport facilities and infrastructure,

(III) energy infrastructure and facilities,

(IV) telecommunications infrastructure and facilities,

(V) water and wastewater infrastructure and facilities,

(VI) waste management and disposal infrastructure, or

(VII) recreational infrastructure, including sports facilities and playgrounds,

(iv) that is subject to a statutory designation that may preclude development, or

(v) on which the derelict sites levy is payable in accordance with the Derelict Sites Act 1990.

The Government’s Housing For All – A New Housing Plan for Ireland proposed a new tax to activate vacant land for residential purposes as a part of the Pathway to Increasing New Housing Supply.

The Residential Zoned Land Tax was introduced in the Finance Act 2021. The process to identify land to which the tax applies is now underway and the tax will be payable from 2025.

The objective of the tax is to activate land that is serviced and zoned for residential use or mixed use, including residential use, in order to increase housing supply and to ensure regeneration of vacant and idle lands in urban locations. These locations have been identified within statutory land use plans as being appropriate locations for housing and they have benefitted from investment in the key services to support the delivery of housing.

The RZLT process has two parts

1) Identification and mapping of the land in scope for the tax. This is undertaken by local authorities through the publication of annual draft and annual final maps – see below.

2) Administration of the tax, which is to be undertaken by the Revenue Commissioners from 2025 onwards.

Identification of land liable to RZLT

Fingal County Council has prepared an annual draft map of the land considered to be in scope for the RZLT as of January 1 2024.

In Scope Residential Lands in Fingal: 3,519 Hectares

In Scope Mixed Use Lands in Fingal: 207 Hectares

A copy of the annual draft map may be inspected from Thursday 1st February 2024 at the following locations:

Fingal County Council Offices:

(During normal office hours, Monday to Thursday 9.00am – 5.00pm and Friday 9.00am to 4.30pm):

- County Hall, Main Street, Swords, Co. Dublin, K67 X8Y2

- Civic Offices, Grove Road, Blanchardstown, Dublin 15, D15 W638

Other Locations:

- On Fingal County Council’s website https://www.fingal.ie/ResidentialZonedLandTax

- On Fingal Council’s Consultation Portal at https://consult.fingal.ie/

Any interested individuals or parties may make submissions in respect of land on the annual draft map. This is dealt with in further detail below.

Please note that although they are included on the map, residential properties are not subject to RZLT if they are subject to Local Property Tax. It is not necessary to make a submission to remove this type of residential property from the map.

Submissions can be made by the public on the annual draft map from 1 February 2024 until 1 April 2024. These submissions can

- propose a correction to the annual draft Residential Zoned Land Tax map if they feel that the land included on the map does not meet the criteria;

- propose a correction to the date on which land first met the criteria;

- support of the exclusion of their land where it is identified on the map that the Local Authority proposes to exclude such land from the final annual map for 2025, to be published on or before 31 January 2025; and/or

- propose the inclusion of land, not identified on the map, if it is considered such land meets the criteria.

Landowners may request a change of zoning of their land by 31 May 2024, where such land is identified on an annual draft map.

Land appearing on the annual draft maps, as amended to take into account the outcome of submissions and rezoning requests made in respect of the land on these maps, will be included on the annual final map of land in scope for the tax in the Local Authority area to be published on 31 January 2025. This land will be subject to the tax in 2025 unless it is exempt as a residential property, as outlined above, or qualifies for any other exemption, as provided for in the legislation.

The RZLT map as prepared and published by the local authorities includes lands that meet the relevant criteria for inclusion on the map as set out in the legislation.

The administration of the RZLT is a matter for the Revenue Commissioners.

The legislation underpinning the RZLT may be found at Part 22A of the Taxes Consolidation Act 1997. Guidance in respect of the administration of the tax may be found here.

Guidance on the Residential Zoned Land Tax, as prepared and published by the Department of Housing, Local Government and Heritage, to assist planning authorities in publishing the maps can be viewed here.

You can find answers to some frequently asked questions about the RZLT and how to make a submission in 'Your Questions Answered'

Making a submission

Submissions can be made by 1 April to:

- Identify additional land which may fall into scope, but which is not included in the annual draft map;

- Challenge the inclusion of land on the map if the owner considers that the land does not meet the criteria which determine the land in scope;

- Challenge the date from which the land is considered to be in scope; and/or Support the proposed exclusion of land.

Submissions can be made by 31 May 2024 to request a change of zoning of land identified on the annual draft map for 2025.

Please note your submission must clearly identify the site and outline what change (i.e. exclusion of land on a Local Authority map, or the date on which the site first met the criteria for inclusion on the map) to the Residential Zoned Land Tax mapping you are seeking, as well as provide a justification for the change sought. The submission must state the criteria set out in Section 653B of the Taxes Consolidation Act 1997 on which you rely in your submission for the land being in or out of scope. The Local Authority may also request additional information after the receipt of your submission (e.g. proof of ownership or further information).

Landowner submissions

If you are making a submission in respect of land that you own or on behalf of the landowner, please note the following:

- Your name and address

- Submissions from a landowner in respect of their own land must be accompanied by an Ordnance Survey map showing the property at an appropriate scale, 1:1000 (urban areas) or 1:2500 (rural areas) suitable to identify the land in question. Please note the Local Authority may request proof of site ownership.

- If your land is on the map, you may wish to bring to the Local Authority’s attention matters which demonstrate that the land is not in scope for the tax, or that the date which the land was considered in-scope is not correct and should be changed.

- Reference to criteria in Section 653B of the Taxes Consolidation Act 1997 – any submission should reference these along with evidence for consideration by the Local Authority to support any claims regarding the serviced nature of the land or any exclusions which should be applied. These criteria must also be referenced if the submission seeks to include additional land on the map.

- The submission should set out any justification for inclusion or exclusion of land,

with reference to the criteria in the legislation.

- If you are making a submission in relation to zoning, please note that a submission requesting a change in zoning can only be made in relation to land that is already on the map.

- Where a land use zoning change is sought, the submission must be received on or before 31 May 2024 and the landowner should set out why the change in zoning is in the interest of the proper planning and sustainable development of the area, as well as any other circumstances which they wish to bring to the Local Authority’s attention.

Third Party submissions

If you are making a submission about land that you don’t own then you are a third-party submitter. Third parties cannot make a submission in relation to zoning.

In your submission you should include:

- Your name and address

- Information to identify the land - either a written description, an Eircode or a map with the area outlined. Where the Local Authority cannot identify the land they may not be able to take the submission into account.

- For land on the map, you may wish to bring to the Local Authority’s attention matters which demonstrate that the land is not in scope for the tax, or that the date which the land was considered in-scope is not correct and should be changed.

- Is the land not currently on the draft map and is your submission recommending that it should be considered in scope for the tax?

- Reference to criteria in Section 653B of the Taxes Consolidation Act 1997 – any submission should reference these along with evidence for consideration by the Local Authority to support any claims regarding the serviced nature of the land or any exclusions which should be applied. These criteria must also be referenced if the submission seeks to include additional land on the map.

- The submission should set out any justification for inclusion or exclusion of land,

with reference to the criteria in the legislation.

In what format should the submission be made?

Submissions may be made:-

- Online at the Council’s Consultation Portal at https://consult.fingal.ie/ or

- In writing to Senior Executive Officer, Planning and Strategic Infrastructure Department, Fingal County Council, County Hall, Main Street, Swords, Co. Dublin K67 X8Y2

In respect of making any submission, be it by the landowner or a third party, please note the following:

- The personal information (data) collected during the consultation process is collected for the purpose of receiving and dealing with submissions.

- Contact details provided may be used to contact a submitter who claims to be the landowner of a particular site. This will be to request evidence as is necessary to prove their ownership of the site, or request further information from the landowner.

- A Local Authority may, where it considers it necessary for the purposes of making the determination, request further information from Irish Water, the National Roads Authority or from a person referred to in article 28 of the Planning and Development Regulations 2001.

- For further information on how Fingal County Council processes Personal Data please see our Privacy Statement https://consult.fingal.ie/en/content/privacy-statement

- Please identify any parts of your submission which contain personal or commercially sensitive data which you do not wish to be published.

What Happens Next

All written submissions will be evaluated. A written determination will be made by the Local Authority regarding submissions by landowners. Key steps the Local Authority will take prior to publishing an annual final map include, but are not limited to the following.

Annual Draft Map

- Submissions received in relation to the annual draft map will be published on the Local Authority website by 11 April 2024 (note: personal data, i.e. name, address of submitter and contact details of the submitter, are redacted, but location of lands to which the submission relates are published along with the grounds of the submission).

- Where a landowner requests the exclusion of their site from the annual draft map on the basis that it does not meet the criteria for being in scope, or challenges the date from which land on the map met this criteria, the Local Authority must notify the owner of its decision not later than 1 July 2024.

- An appeal of the Local Authority decision on a landowner’s submission on the annual draft map, must be lodged by the landowner with An Bord Pleanála by 1 August 2024.

- Rezoning submissions are considered by the Local Authority. A decision on whether to progress with an intended variation to the statutory land use plan or not is to be communicated in writing to the relevant landowner by 31 July 2024. There is no appeal regarding rezoning requests to An Bord Pleanála.

Where a person has requested the addition of a site to the draft map and the Local Authority considers that sites in respect of which submissions have been made or based on the information available to the Local Authority, constitute lands satisfying the relevant criteria then these sites will be identified on the next annual draft map which will be published by the Local Authority on 1 February 2025.

Please find link to the mapviewer for the National Data Set here

Can I appeal a decision of the Local Authority?

A landowner has until 1 August 2024 to appeal the Local Authority decision regarding submissions made in respect of the exclusion of their site from the annual draft map on the basis that it does not meet the criteria for being in scope, or challenging the date from which land on the map met this criteria date to An Bord Pleanála. Appeals must be made in writing setting out the grounds of appeal. There are no provisions for a third party to appeal a Local Authority decision to retain or remove land from an annual draft map.

How can I find out further information about the mapping and submissions process?

If further information is required on the annual draft map process or on making a submission please check ‘Your Questions Answered’ which can be found here. If your query relates to a particular area of land or if the answer is not contained in the FAQ’s ‘Your Questions Answered’ contact the Planning Department - by telephone at 01 8905000 at [email protected] .

Further information on the process is also available on the Gov.ie/RZLT website.

As outlined above, the RZLT process has two parts. Local authorities are required to undertake the mapping which identifies the land which is subject to the tax, including an annual final map which will be first published on 31 January 2025, and revised annually. Thereafter, the administration of the tax will be undertaken by the Revenue Commissioners.

As the Local Authority do not administer the tax we are unable to answer any queries regarding the administration of the tax. All queries regarding the administration of the tax should be directed to the Revenue Commissioners

Having regard to the respective roles of local authorities and the Revenue Commissioners in the RZLT process, queries on the mapping should be made to Fingal County Council. This includes queries on;

- Criteria for inclusion on annual draft map

- Submissions on annual draft map

- Determinations on annual draft map

- Zoning submissions

- Appeals (which must be submitted to An Bord Pleanála)

- Annual final map

The Revenue Commissioners website–provides details on the general administration of the tax and links to a comprehensive guide to the tax. The Revenue website also provides details on

- Liable persons

- Amount of residential zoned land tax

- Obligation to register

- Obligation on liable person to prepare and deliver return

- Deferral of, or exemptions from, Residential Zoned Land Tax

- How to contact Revenue with queries on the administration of RZLT

What do I do if I am a Homeowner

My house and garden is contained on the map. What is the consequence?

Your house and garden is identified on the map because it meets the criteria for the tax, which is based on residential led zonings and servicing by infrastructure suitable for provision of housing. The house and garden are not liable for the tax, as long as the house is subject to Local Property Tax (LPT).

Do I need to make a submission?

It’s not necessary. Even if your house is identified on the maps, residences are not liable for the tax where they are subject to LPT.

What if my garden is greater than 0.4047ha (1 acre) –

If your garden is greater than this size, then you need to register for the RZLT with the Revenue Commissioners, however your house and garden will not be liable for the tax. You will be able to register for RZLT from December 2024 onwards. No action needs to be taken to register at this time. Please see revenue.ie for details regarding the registration process closer to the time.

Criteria for inclusion in map

Section 653B of the Taxes Consolidation Act 1997 states:-

In this Part, a reference to land which satisfies the relevant criteria is a reference to land that—

(a) is included in a development plan, in accordance with section 10(2) (a) of the Act of 2000, or local area plan, in accordance with section 19(2)(a) of the Act of 2000, zoned—

(i) solely or primarily for residential use, or

(ii) for a mixture of uses, including residential use,

(b) it is reasonable to consider may have access, or be connected, to public infrastructure and facilities, including roads and footpaths, public lighting, foul sewer drainage, surface water drainage and water supply, necessary for dwellings to be developed and with sufficient service capacity available for such development, and

(c) it is reasonable to consider is not affected, in terms of its physical condition, by matters to a sufficient extent to preclude the provision of dwellings, including contamination or the presence of known archaeological or historic remains, but which is not land—

(i) that is referred to in paragraph (a)(i) and, having regard only to development (within the meaning of the Act of 2000) which is not unauthorised development (within the meaning of the Act of 2000), is in use as premises, in which a trade or profession is being carried on, that is liable to commercial rates, that it is reasonable to consider is being used to provide services to residents of adjacent residential areas,

(ii) that is referred to in paragraph (a)(ii), unless it is reasonable to consider that the land is vacant or idle,

(iia) the development of which would not conform with—

(I) in a case in which the land is zoned in a development plan, the phased basis in accordance with which development of land is to take place under the plan, as detailed in the core strategy included in that plan in accordance with section 10(2A)(d) of the Act of 2000, or

(II) in a case in which the land is zoned in a local area plan, the objective, consistent with the objectives and core strategy of the development plan for the area in respect of which the local area plan is prepared, of development of land on a phased basis, included in the local area plan in accordance with section 19(2) of the Act of 2000, on the date on which satisfaction of the criteria in this section is being assessed,

(iii) that it is reasonable to consider is required for, or is integral to, occupation by—

(I) social, community or governmental infrastructure and facilities, including infrastructure and facilities used for the purposes of public administration or the provision of education or healthcare,

(II) transport facilities and infrastructure,

(III) energy infrastructure and facilities,

(IV) telecommunications infrastructure and facilities,

(V) water and wastewater infrastructure and facilities,

(VI) waste management and disposal infrastructure, or

(VII) recreational infrastructure, including sports facilities and playgrounds,

(iv) that is subject to a statutory designation that may preclude development, or

(v) on which the derelict sites levy is payable in accordance with the Derelict Sites Act 1990.

Residential Zoned Land Tax (RZLT)

The Residential Zoned Land Tax (RZLT) is a tax aimed at activating serviced and residentially zoned land for housing. Local authorities are responsible for identifying the land that is subject to RZLT.

Introduction

The Residential Zoned Land Tax was introduced in the Finance Act 2021. The objective of the tax is to activate land that is serviced and zoned for residential use or mixed use, including residential use, in order to increase housing supply and to ensure regeneration of vacant and idle lands in urban areas. These areas have been identified within statutory land use plans as appropriate locations for housing and they have benefitted from investment in the key services to support the delivery of housing.

- Local authorities are responsible for identifying the land that is subject to Residential Zoned Land Tax.

- Residential Zoned Land Tax is administered by Revenue.

Land subject to RZLT

The process to identify and map land that is subject to RZLT is undertaken annually by local authorities.

The initial mapping process has involved local authorities publishing draft and supplemental maps and allowing landowners, and others, to make submissions on these maps. Submissions by landowners could challenge the inclusion of their land on a map, the date on which land first met the relevant criteria, or they could seek to re-zone the land.

Fingal County Councils final RZLT map for 2024 is now available here and at our public office at County Hall, Main Street, Swords.

The map includes lands that meet the relevant criteria for inclusion on the map as set out in the current legislation.

In Scope Residential Lands in Fingal: 3,519 Hectares

In Scope Mixed Use Lands in Fingal: 209 Hectares

The final map does not reflect appeal decisions or judicial review decisions made after 1 November 2023 regarding land identified on the draft or supplemental maps published in November 2022 and May 2023, respectively. Where these decisions are made by 1 January 2024, they will be reflected on the draft revised final map for 2025 – see below. The revised final map will be published by 31 January from 2025 onwards.

Residential Zoned Land Tax will be charged annually from 1 February 2025 onwards (subject to the passing of Finance (No.2) Bill 2023). The tax will be administered by the Revenue Commissioners and landowners will have to register for the tax – further information regarding the administration of the tax by Revenue is available here.

Making submissions on the RZLT map

There is no opportunity to make submissions in respect of land identified on the final map published on 1 December 2023.

There will be a chance to make submissions in respect of land on the draft revised final map for 2025 during 2024.

A draft revised final RZLT map for 2025 will be published by 1st February 2024.

The draft revised final RZLT map for 2025 will include land that the local authority considers to be in scope for the tax, which may include land already identified on the 2024 final map, published by 1 December 2023. The draft revised final map will reflect any legislative, zoning or servicing changes and any appeal or review outcomes, as of 1 January 2024.

Submissions can challenge the inclusion or exclusion of land on the draft revised final map for 2025 based on the relevant criteria. In addition, rezoning requests may be made by owners of land on the map.

Residential properties

Please note that although they are included on the map, residential properties are not subject to RZLT if they are subject to Local Property Tax. It is not necessary to make a submission to remove this type of residential property from the map.

More information

The legislation underpinning the RZLT may be found at Part 22A of the Taxes Consolidation Act 1997. Guidance in respect of the administration of the tax may be found here.

Please find link to the mapviewer for the National Data Set here

Residential Zoned Land Tax(RZLT)

The Government’s ‘Housing For All – A New Housing Plan for Ireland ‘ proposed a new tax to activate vacant land for residential purposes as a part of the Pathway to Increasing New Housing Supply.

The Residential Zoned Land Tax was introduced in the Finance Act 2021. The process to identify land to which the tax applies is now underway and the tax will be payable from 2024.

The objective of the tax is to activate land that is serviced and zoned for residential use or mixed use, including residential use, in order to increase housing supply and to ensure regeneration of vacant and idle lands in urban locations. These locations have been identified within statutory land use plans as being appropriate locations for housing and they have benefitted from investment in the key services to support the delivery of housing.

The RZLT process has two parts:-

1) Identification and mapping of the land in scope for the tax. This is undertaken by local authorities through the publication of draft and supplemental maps – see below.

2) Administration of the tax, which is to be undertaken by the Revenue Commissioners from 2024 onwards.

Identification of land liable to RZLT

Fingal County Council has prepared a draft map of the land considered to be in scope for the RZLT as of October 1, 2022.

The draft map is available to view here and at:

Fingal County Council Offices: (during normal office hours, Monday to Thursday 9.00am-5.00pm and Friday 9.00am to 4.30pm)

- County Hall, Main Street, Swords, Co. Dublin, K67X8Y2

- Civic Offices, Grove Road, Blanchardstown, Dublin 15,

Any interested individuals or parties may make submissions in respect of land on the draft map. This is dealt with in further detail below.

Please note that although they are included on the map, residential properties are not subject to RZLT if they are subject to Local Property Tax. It is not necessary to make a submission to remove this type of residential property from the map.

Submissions can be made by the public on the draft map from November 1st 2022 until January 1st 2023. These submissions can challenge the inclusion of particular lands on the draft map on the basis that those lands do not meet the criteria set out within the relevant legislation; the date on which the land is considered to meet this criteria; or can request a change of zoning. During the draft map stage, submissions can also identify additional land which appears to meet the criteria and so falls into scope and which may be placed on the supplemental map.

A supplemental map will be published on 1 May 2023 identifying additional land considered to be in scope as a result of a change of zoning, servicing or where the local authority becomes aware of the fact that land, which didn’t appear on the draft map, may meet the criteria for being in scope, such as where this has been identified during submissions. The supplemental map will also be on public display and open to submissions which may challenge the inclusion of additional land on the map.

Land appearing on both the draft and supplemental maps, as amended to take into account the outcome of submissions made in respect of the land on these maps, will be included on the final map of land in scope for the tax in the local authority area to be published on 1 December 2023. This land will be subject to the tax unless it is exempt as a residential property, as outlined above.

The RZLT map as prepared and published by the local authorities includes lands that meet the relevant criteria for inclusion on the map as set out in the legislation.

The administration of the RZLT is a matter for the Revenue Commissioners.

The legislation underpinning the RZLT may be found at Part 22A of the Taxes Consolidation Act 1997.

Guidance in respect of the administration of the tax may be found here

You can find answers to some frequently asked questions about the RZLT and how to make a submission here

Making a submission

Please note: All Submissions received in relation to the draft map will be published on the local authority website by 11th January 2023 (note: personal data, i.e. address and contact details of the submitter, are redacted, but location of lands to which the submission relates are published along with the grounds of the submission)

Submissions can be made to:

- Challenge the inclusion of land on the map if the owner considers that the land does not meet the criteria which determine the land in scope

- Challenge the date the land is considered to be in scope

- Request a change of zoning.

- Identify additional land which may fall into scope (for draft map only)

Please note your submission must clearly identify the site and outline what change (i.e. inclusion or exclusion of land on a local authority map, or the date on which the site first met the criteria for inclusion on the map) to the Residential Zoned Land Tax mapping you are seeking, as well as provide a justification for the change sought.

The submission must state the criteria set out in Section 653B of the Taxes Consolidation Act 1997 on which you rely in your submission for the land being in or out of scope. The local authority may also request additional information after the receipt of your submission (e.g. proof of ownership or further information).

Landowner submissions

If you are making a submission in respect of land that you own or on behalf of the landowner, please note the following:

- Your name and address.

- The name and address of the landowner (if making a submission on their behalf).

- Submissions from a landowner in respect of their own land must be accompanied by an Ordnance Survey map showing the property at an appropriate scale, 1:1000 (urban areas) or 1:2500 (rural areas) suitable to identify the land in question.

- Proof of ownership (A copy of the relevant folio or a copy of deed of title will suffice).

- If your land is on the map, you may wish to bring to the local authority’s attention matters which demonstrate that the land is not in scope for the tax, or that the date which the land was considered in-scope is not correct and should be changed.

- Reference to criteria in Section 653B of the Taxes Consolidation Act 1997 – any submission should reference these along with evidence for consideration by the local authority to support any claims regarding the serviced nature of the land or any exclusions which should be applied. These criteria must also be referenced if the submission seeks to include additional land on the map.

- The submission should set out any justification for inclusion or exclusion of land,

with reference to the criteria in the legislation.

- If you are making a submission in relation to zoning, please note that a submission requesting a change in zoning can only be made in relation to land that is already on the map.

- Where a land use zoning change is sought, the landowner should set out why the change in zoning is in the interest of the proper planning and sustainable development of the area, as well as any other circumstances which they wish to bring to the local authority’s attention.

Third Party submissions

If you are making a submission about land that you don’t own then you are a third-party submitter. Third parties cannot make a submission in relation to zoning.

In your submission you should include:

- Your name and address

- Information to identify the land - either a written description, an Eircode or a map with the area outlined. Where the local authority cannot identify the land they may not be able to take the submission into account.

- For land on the map, you may wish to bring to the local authority’s attention matters which demonstrate that the land is not in scope for the tax, or that the date which the land was considered in-scope is not correct and should be changed.

- Is the land not currently on the draft map and is your submission recommending that it should be considered in scope for the tax?

- Reference to criteria in Section 653B of the Taxes Consolidation Act 1997 – any submission should reference these along with evidence for consideration by the local authority to support any claims regarding the serviced nature of the land or any exclusions which should be applied. These criteria must also be referenced if the submission seeks to include additional land on the map.

- The submission should set out any justification for inclusion or exclusion of land,

with reference to the criteria in the legislation.

In what format should the submission be made?

- Online: via the Council’s Consultation Portal https://consult.fingal.ie/en/browse

Or

- By post in writing addressed to: Senior Executive Officer, Planning & Strategic Infrastructure Department, Fingal County Council, County Hall, Main Street, Swords, Co Dublin K67 X8Y2.

Submissions can be made from Tuesday 1st November 2022 and must be received before 11.59pm on Sunday 1st January 2023.

Only submissions received before 11.59pm on Sunday 1st January 2023 will be considered.

In respect of making any submission, be it by the landowner or a third party, please note the following:

- The personal information (data) collected during the consultation process is collected for the purpose of receiving and dealing with submissions.

- Contact details provided may be used to contact a submitter who claims to be the landowner of a particular site. This will be to request evidence as is necessary to prove their ownership of the site, as per 653D(4) of the Taxes Consolidation Act 1997 or request further information from the landowner as per 653E(2) of the Taxes Consolidation Act 1997.

- A local authority may, where it considers it necessary for the purposes of making the determination, within 21 days from the date referred to in 653D(1) of the Taxes Consolidation Act 1997, request further information from Irish Water, the National Roads Authority or from a person referred to in article 28 of the Planning and Development Regulations 2001.

- For further information on how Fingal County Council processes Personal Data please see our Privacy Statement here

- Please identify any parts of your submission which contain personal or commercially sensitive data which you do not wish to be published.

What Happens Next

All written submissions will be evaluated. A written determination will be made by the Local authority regarding submissions by landowners. Key steps the local authority will take prior to publishing a final map include, but are not limited to the following.

Draft Map

- Submissions received in relation to the draft map will be published on the local authority website by 11th January 2023 (note: personal data, i.e. name, address of submitter and contact details of the submitter, are redacted, but location of lands to which the submission relates are published along with the grounds of the submission).

- Where a landowner requests the exclusion of their site from the draft map on the basis that it does not meet the criteria for being in scope, or challenges the date from which land on the map met this criteria, the local authority must notify the owner of its decision not later than 1st April 2023.

- An appeal of the local authority decision on a landowner’s submission on the draft map, must be lodged by the landowner with An Bord Pleanála by 1st May 2023.

- Where a person has requested the addition of a site to the draft map and the local authority considers that sites in respect of which submissions have been made or based on the information available to the local authority, constitute lands satisfying the relevant criteria then these sites will be identified on a supplemental map of land in scope for the tax which will be published by the local authorities on 1st May 2023.

Supplemental Map

- Submissions in respect of land identified on the supplemental map only must be made by 1st June 2023.

- Submissions received in relation to the supplemental map will be published on the local authority website by 11th June 2023 (note: personal data, i.e. name, address of submitter and contact details of the submitter, are redacted, but location of lands to which the submission relates are published along with the grounds of the submission).

- Where a landowner requests the exclusion of their site from the supplemental map on the basis that it does not meet the criteria for being in scope, or challenges the date from which land on the map met this criteria, the local authority must notify the owner of its decision not later than 1st August 2023.

- Where a landowner wishes to appeal a decision by the local authority to keep land on the Supplemental Map to An Bord Pleanála they must do so by 1st September 2023.

- The local authority must - reflecting the outcome of any appeals to the Board, any additions or exclusions to maps on foot of determinations made by the local authorities in response to submissions made or changes in zoning – prepare and publish a final map by 1st December 2023.

- Where a landowner has requested a change to the zoning of their land, the Local Authority shall evaluate the submission and consider whether to propose the making of a variation. (An initiation of the variation process will only take place after evaluation of any requests for change of zoning made in relation to the draft and supplemental maps in order to allow all requests for changes to zoning to be considered together)

Further information on the process is available in ‘Residential Zoned Land Tax - Guidelines for Planning Authorities’ as published by the Department of Housing, Local Government and Heritage. here

Can I appeal a decision of the local authority?

A landowner has until 1 May 2023 to appeal the local authority decision regarding submissions made in respect of the draft map to An Bord Pleanála and until 1 September 2023 to appeal the local authority decision regarding submissions in respect of the supplemental map. Appeals must be made in writing setting out the grounds of appeal. There are no provisions for a third party to appeal a local authority decision to retain or remove land from a draft or supplemental map

How can I find out further information about the mapping and submissions process?

If further information is required on the draft map process or on making a submission please check ‘Your Questions Answered’ which can be found here. If your query relates to a particular area of land or if the answer is not contained in the FAQ’s email [email protected]

Further information on the process is also available via ‘Residential Zoned Land Tax - Guidelines for Planning Authorities’. here

As outlined above, the RZLT process has two parts. Local authorities are required to undertake the mapping which identifies the land which is subject to the tax, including an annual update of the final map which will be published on 1 December 2023. Thereafter, the administration of the tax will be undertaken by the Revenue Commissioners.

As the local authority do not administer the tax we are unable to answer any queries regarding the administration of the tax. All queries regarding the administration of the tax should be directed to the Revenue Commissioners.

Having regard to the respective roles of local authorities and the Revenue Commissioners in the RZLT process, queries on the mapping should be made to Fingal County Council at

- Criteria for inclusion on Draft map

- Submissions on Draft Map

- Determinations on Draft Map

- Supplemental map

- Submissions on supplemental map

- Determinations on Supplemental map

- Zoning submissions

- Appeals (which must be submitted to An Bord Pleanála)

- Final map

- Annual revised Final map

Queries on administration of the tax should be made to the Revenue Commissioners website –This includes queries on;

- What constitutes a relevant site for the purpose of RZLT

- Liable persons

- Amount of residential zoned land tax

- Obligation to register

- Obligation on liable person to prepare and deliver return

- Abatements

- Deferral of residential zoned land tax

What do I do if I am a Homeowner

My house and garden is contained on the map. What is the consequence?

Your house and garden is identified on the map because it meets the criteria for the tax, which is based on residential led zonings and servicing by infrastructure suitable for provision of housing. The house and garden are not liable for the tax, as long as the house is subject to Local Property Tax (LPT).

Do I need to make a submission?

It’s not necessary. Even if your house is identified on the maps, residences are not liable for the tax where they are subject to LPT.

What if my garden is greater than 0.4047ha (1 acre) –

If your garden is greater than this size, then you need to register for the RZLT with the Revenue Commissioners, however your house and garden will not be liable for the tax. You will be able to register for RZLT from late 2023 onwards. No action needs to be taken to register at this time. Please see www.revenue.ie for details closer to the time.

Criteria for inclusion in map

Section 653B of the Taxes Consolidation Act 1997 states:-

In this Part, a reference to land which satisfies the relevant criteria is a reference to land that—

(a) is included in a development plan, in accordance with section 10(2) (a) of the Act of 2000, or local area plan, in accordance with section 19(2)(a) of the Act of 2000, zoned—

(i) solely or primarily for residential use, or

(ii) for a mixture of uses, including residential use,

(b) it is reasonable to consider may have access, or be connected, to public infrastructure and facilities, including roads and footpaths, public lighting, foul sewer drainage, surface water drainage and water supply, necessary for dwellings to be developed and with sufficient service capacity available for such development, and

(c) it is reasonable to consider is not affected, in terms of its physical condition, by matters to a sufficient extent to preclude the provision of dwellings, including contamination or the presence of known archaeological or historic remains, but which is not land—

(i) that is referred to in paragraph (a)(i) and, having regard only to development (within the meaning of the Act of 2000) which is not unauthorised development (within the meaning of the Act of 2000), is in use as premises, in which a trade or profession is being carried on, that is liable to commercial rates, that it is reasonable to consider is being used to provides services to residents of adjacent residential areas,

(ii) that is referred to in paragraph (a)(ii), unless it is reasonable to consider that the land is vacant or idle,

(iii) that it is reasonable to consider is required for, or is integral to, occupation by—

(I) social, community or governmental infrastructure and facilities, including infrastructure and facilities used for the purposes of public administration or the provision of education or healthcare,

(II) transport facilities and infrastructure,

(III) energy infrastructure and facilities,

(IV) telecommunications infrastructure and facilities,

(V) water and wastewater infrastructure and facilities,

(VI) waste management and disposal infrastructure, or

(VII) recreational infrastructure, including sports facilities and playgrounds,

(iv) that is subject to a statutory designation that may preclude development, or

(v) on which the derelict sites levy is payable in accordance with the Derelict Sites Act 1990.